Handbook on supervisory benchmarking

The Handbook on Supervisory Benchmarking of Internal Models is an online tool that provides guidance and links to the important documents relevant for this exercise. It is regularly updated and includes links to the published Q&As.

Competent authorities, together with the EBA, are monitoring the risk weighted exposure amounts resulting from the use of internal approaches for market, credit risk and IFRS9 on a yearly basis.

For this purpose, institutions are requested to submit annually the relevant data to its CAs (and the EBA). Based on this data submission the EBA calculates benchmarks which are then provided to CAs. The CAs use these benchmarks to monitor and assess the risk weighted exposure amounts resulting from the use of internal approaches.

The legal basis for the benchmarking exercises is laid down in the Capital Requirements Directive (CRD) in Article 78, which provides the following mandates as well to the EBA:

a) Regulatory Technical Standards (RTS) on the assessment of the internal approaches adopted by institutions and the procedures for sharing those assessments between competent authorities;

b) Implementing Technical Standards (ITS) specifying the benchmarking portfolios and reporting instructions for institutions to be applied in the annual benchmarking exercises. These ITS specify the required data to be submitted by institutions and it is revised annually to keep the exercise informative.

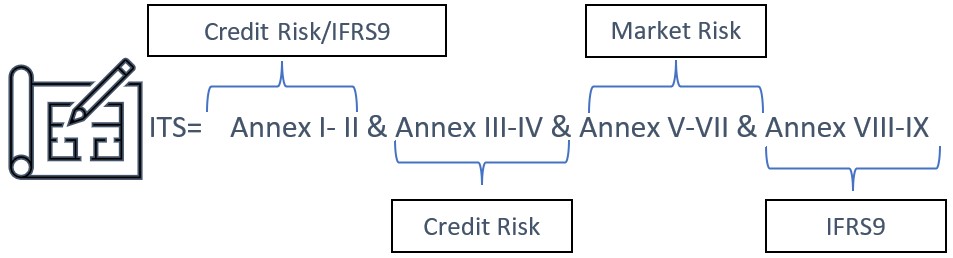

These annual Implementing Technical Standards (ITS) are composed of a main legal act and 9 Annexes: Annex I-IV regarding credit risk, Annex V-VII regarding market risk and Annex I, II and VIII-IX for IFRS9 Benchmarking.

As for any other legislation that falls into EBA’s remit, stakeholders can submit questions on the practical application or implementation of the ITS for the Supervisory Benchmarking exercise using the Q&A tool supervisory benchmarking on the EBA website. Subject to an admissibility assessment the submitted questions are discussed, answered and the final answer is published on this webpage. The submitter receives an automated notification once an answer to the respective question is provided in the updated version of the Q&A list in the Handbook. The submitter will also receive a direct link to the final Q&A.

This website provides an overview of key elements related to the Supervisory Benchmarking exercise as well as to the relevant Q&As. The benchmarking exercise is run in close collaboration with competent authorities. Consequently, questions on processes specific to a certain jurisdiction should be discussed with the respective competent authorities.

| Latest update of this webpage | Updated section(s) | Description |

|---|---|---|

| V1.0 | All | Initial version |

| V1.1 | 2.6, 2.1.1 | New Q&A answer added (QA 2023_CR01 Assignment of exposures to benchmarking portfolios) |

Annex I is an excel worksheet which defines the benchmarking portfolios/counterparties to be used for submitting the data fields specified in the relevant templates in Annex III (for credit risk) and in the templates in Annex VIII (for IFRS9). The following table provides an overview on how to link the benchmarking portfolios defined in Annex I to the relevant templates:

Sheet Number | BM Type | Template for data to be collected | Annex | Name of the template /group of templates |

|---|---|---|---|---|

101 | IRB | C 101.00 | Annex III | Definition of Low Default Portfolio counterparties (single names) |

IFRS9 | C 111.00, C 112.00, C 113.00, C 114.00 | Annex VIII | ||

102 | IRB | C 102.00, C105.01, C105.02, C105.03 | Annex III | Definition of Low Default Portfolios (LDP) |

103 | IRB | C 103.00, C105.01, C105.02, C105.03 | Annex III | Definition of High Default Portfolios (HDP) |

Table 1: Link between Annex I and the Templates to be filled in

As an example, the IRB relevant benchmarking data that is to be submitted for the counterparties specified in sheet 101 of Annex I, is specified in template C 101.00 of Annex III (with the relevant instructions in Annex IV). The IFRS9 relevant benchmarking data that is to be submitted for the counterparties specified in sheet 101 of Annex I, is specified in templates C 111.00, C 112.00, C 113.00, C 114.00 of Annex VIII (with the relevant instructions in Annex IX).

Next to the Supervisory Benchmarking exercise, credit institutions have several other reporting obligations, such as the common reporting framework (COREP) and the financial reporting framework (FINREP).

Within COREP, they report their solvency ratio to supervisory authorities under the Capital Requirements Directive (CRD) as well as other relevant supervisory metrics. Reporting guidelines for COREP can be found here.

Within FINREP, credit institutions report their Balance sheet, Income statement, Comprehensive Income and Equity, Disclosure of financial assets and liabilities, off balance sheet activities and non-financial instrument disclosure. Reporting guidelines for FINREP can be found here.

The data required in the benchmarking exercise frequently refers to data fields used in COREP and FINREP. The relevant references to COREP/FINREP for defining the benchmarking portfolios can be found in Annex II and the relevant references to COREP/FINREP for reporting the benchmarking data can be found in Annex IV.

Instructions on how to deal with fields that are not known or zero is provided in Part I of Annex IV.

The tables in Appendix A on this website provide an overview of the data fields and formats required for the templates of Annex III.

The deadline for data submission is specified in the ITS in Article 3. For the credit risk the deadline for data submission is usually the 11 April each year.

Competent authorities forward the relevant data to the EBA. Following the data submission, competent authorities check data quality and revert to institutions in case re-submissions become necessary. The final calculation of benchmarks is performed by the EBA and circulated to the competent authorities each year late in June or early in July.

The EBA does not collect any data directly from institutions, but receives them via the Competent Authorities. Therefore, participating institutions should contact their Competent authority to discuss any specific questions on the data submission.

All questions related to the ITS, the related rules and other guidance provided by the EBA should be addressed using the EBA Q&A Webform. Responses of general interest will be published in this Handbook.

The definition of the benchmarks and how they are computed is documented in the chart pack which is published on the EBA’s website after the annual exercise has been closed (i.e. usually in February or March of the following year).

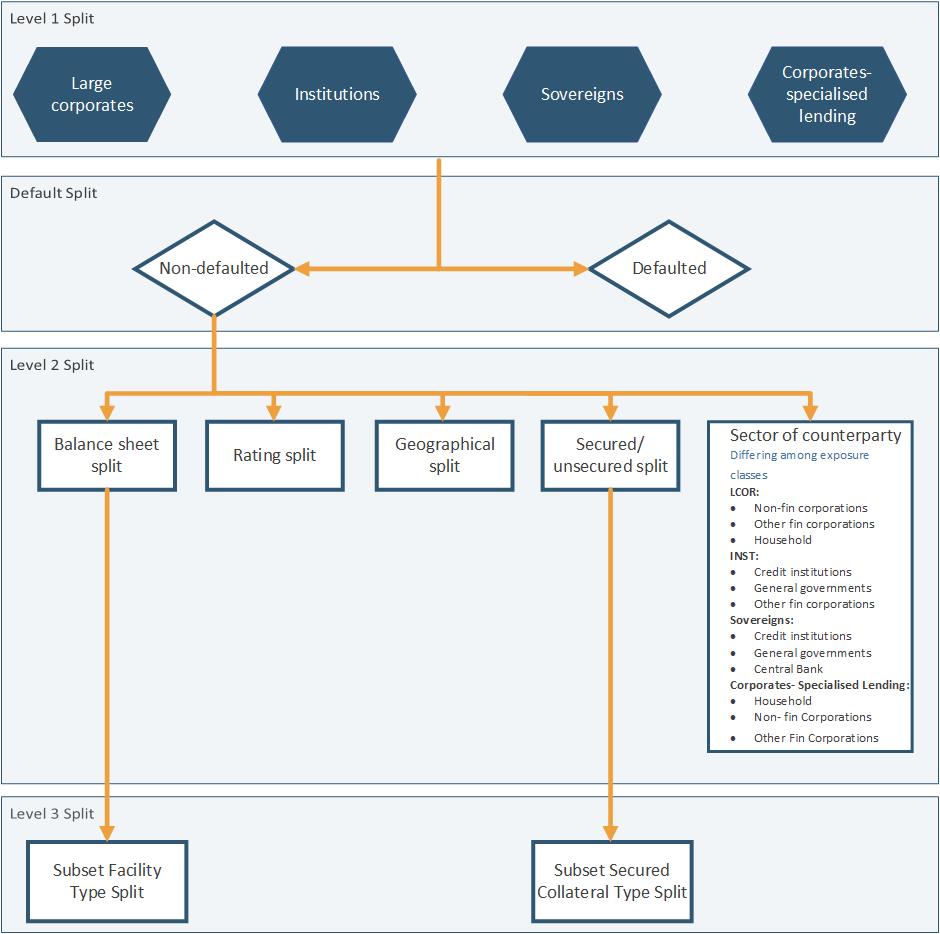

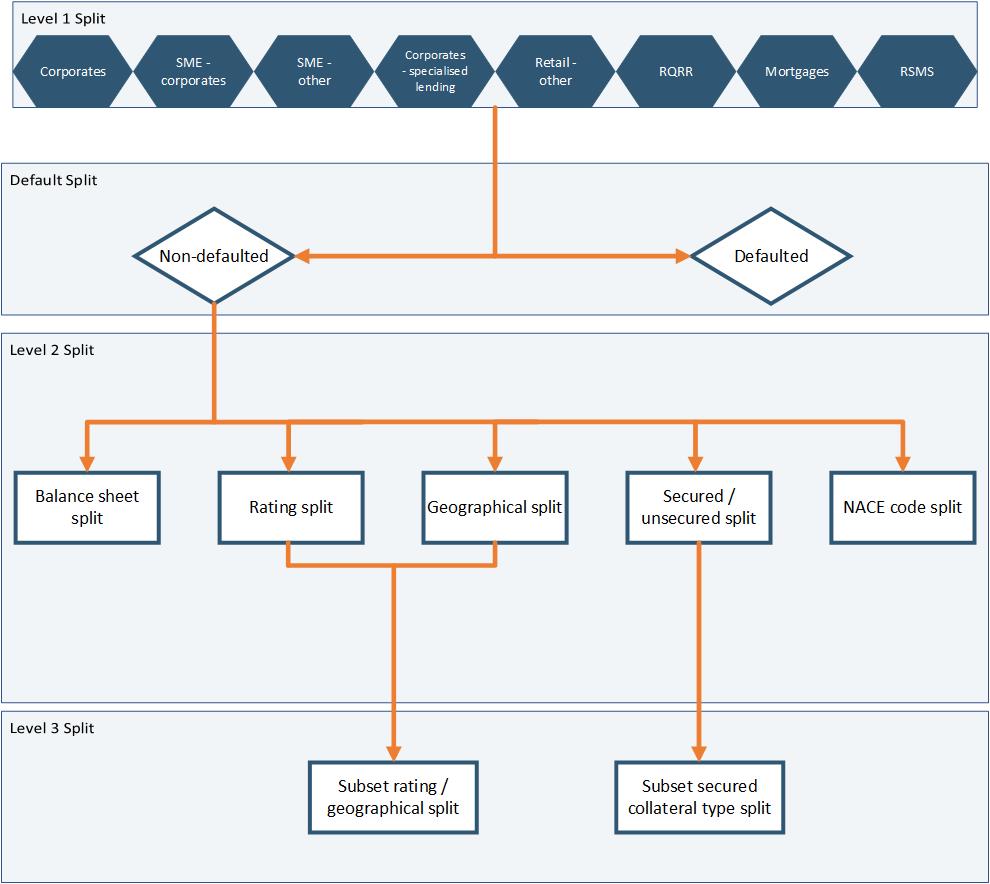

This section describes how the benchmarking portfolios are constructed. Figure 1 and 2 below illustrate the construction and hierarchy of the benchmark portfolios. There are 4 levels of granularity for which the credit risk benchmarking portfolios are specified, the first one is referred to as Level 1 split and represents the total exposure per exposure class which is divided according to the default status of the exposure (Default Split). So each Level 1 portfolio is split into its defaulted and non-defaulted parts. There is no further break-down for defaulted exposure.

For the non-defaulted exposures, there are several characteristics defined in Annex I for which splits are introduced (level 2 split). Therefore, institutions should carefully read Annex I and check the defined characteristics for the different splits.

These characteristics partially differ between the Low Default Portfolios (LDP) and the High Default Portfolios (HDP) (see figure 1 and 2 below). Each combination of characteristics, that describes a benchmarking portfolio is connected to a unique ID, specified in Annex I. Consequently, the combination of exposure class, default status and characteristics from level 2 and level 3 split determines the portfolio ID.

For some characteristics there are further subsets marked as Level 3 split (i.e. for the secured/unsecured split, there is a subset with collateral types for the secured exposures).

There is one Q&A that deals with the assignment of retail exposures to benchmarking portfolios:

Figure 1: Portfolio Composition of low default portfolios

Figure 2: Portfolio composition of high default portfolios

In preparation of each exercise, the EBA publishes the list of validation rules used to ensure data quality in the institutions data submission for credit risk. The list is updated whenever a new release of the reporting framework is published and available for download on the EBA Website.

Competent authorities throughout the EU with the support of the EBA are applying the validation rules to the data submissions of institutions under their remit and approach institutions to resubmit whenever validation rules are failing.

There are 2 different severity categories of validation rules: “Error” and “Warning”. Not meeting "Error" validation rules when submitting data will cause the file to be rejected immediately, therefore the submission is not accomplished. Where reporting entities are of the opinion that they can only comply with the reporting requirements set out in the applicable reporting standard if they breach a validation rule of the type “Error”, they should contact their competent authority.

Validation rules with the severity status “Warning” are not causing an immediate rejection of the submission but should still be investigated and closely monitored by the reporters. Reporters are expected to analyze the results of “Warning” validation rules and verify and revise the data, if necessary. Some warnings may not be applicable to all reporters, in all circumstances, or to all reference dates. As such, not meeting them will not necessarily prevent the successful submission of data. Where a reporter believes that it is not possible to meet the validation rule, the reasons for the inability to comply should be explained to the competent authority.

Warnings may become “Error” validation rules in the future. Except for validation rules reflecting technical requirements, new validation rules are introduced as warnings initially.

Please see Q&A 2018_3934 for further elaboration on a specific validation rule.

In addition, Competent Authorities together with the EBA perform benchmarking specific Data Quality checks. A failing of these checks may trigger questions addressed to the submitting institution and may eventually lead to resubmissions.

2.1.3.1 Allocation of exposures to the secured/unsecured portfolio, collateral split portfolios

Annex I and II of the ITS provide clear instructions on the assignments of collateralization status and collateral types. For a single exposure for one type of collateral, the secured and unsecured share of the exposure should add up to the original exposure value.

There are three Q&As that cover the collateralization split and how exposures should be assigned.

2.1.3.2 Reporting of risk parameter and exposure values on secured/unsecured portfolio and collateral split portfolios

Instructions on the metrics for the secured/unsecured portfolios and the collateral split are included in Annex IV of the ITS.

The reporting of CRM techniques with substitution effect is covered in Q&A 2018_4093 and Q&A 2018_4091.

There are two different ways how the substitution approach can be applied (RWA substitution and risk parameter substitution). With both options, several data points in the reporting are affected.

In template C102 and C103, CCF values should only be reported for off balance sheet exposures. The data point ‘CCF’ should therefore be left blank for on balance sheet exposures denoted by _ONX in the portfolio ID.

For template C101, the scope of CCF data to be collected is specified in Annex IV, Part II of the ITS.

Q&A 2020_5368 covers questions with the weighted average of the CCF.

The data points ‘DR1YR’ and ‘DR5YR’ (1 year and 5 year default rates) refer to observed parameters which can be used in the exercise to explain outlier observations e.g. where the empirically observed default risk in a portfolio is very low this may explain a lower PD estimate compared to peers for a considered portfolio. Instructions for DR1YR and DR5YR can be found in Annex IV of the ITS. This information shall only be reported for portfolio IDs relating to non-defaulted exposures.

Instructions on the metrics for the data points ‘LR1YR’ and ‘LR5YR’ can be found in Annex IV of the ITS.

The loss rate of the latest year shall be reported for portfolio IDs relating to ‘non-defaulted’ and ‘defaulted’ exposures only.

Where the institution is not able to calculate a loss rate for the past five years it shall develop a proxy using its longest history up to 5 years and provide documentation detailing the calculation to its competent authority.

Annex IV of the ITS specifies how the data points ‘RWA--/-/+/++’ need to be reported. Furthermore, Q&A 2016_2782 and Q&A 2020_5339 take up information on these fields.

Template C105 consists of three different sheets named 105.01 (definition of internal models), 105.02 (mapping of internal models to portfolios) and 105.03 (mapping of internal models to countries). Instructions on the template structure as well as on data metrics can be found in the ITS on the EBA Website. Q&A 2015_2503 deals with specificities for filling in sheet C105.01 for LDPs.

While for templates C101-C103 portfolios are defined particularly for the Benchmarking exercise to make bank data more comparable, the aim of template C105 is to collect more granular internal model data for which portfolios are submitted. This implies that template C105 conveys the internal model perspective, while template C101-C103 relate to the portfolio perspective.

Generally, it is possible that institutions have several PD models but only 1 LGD model because the models have different segmentations in the calibration.

To facilitate the mapping of benchmarking portfolios to models, institutio shall only indicate ‘PD’, ‘LGD’ or ‘CCF’ for the data point ‘IRBA Risk parameter’ rather than ‘PD estimate’ in template C105.01.

Institution should make sure to report an Internal model ID (c0010) for each risk parameter that is used in the own funds calculation. In other words, for benchmarking portfolios covering FIRB exposures, only Internal model IDs related to PD models shall be reported and for benchmarking portfolios covering AIRB exposures at least 2 Internal Model IDs should be reported for the respective PD and LGD models and where relevant CCF models.

| Question ID | Relevant Annex/Template | Subject Matter |

|---|---|---|

| 2023_CR01 | Annex II, table 103 | Assignment of exposures to benchmarking portfolios |

| 2020_5368 | Annex IV, Template C101, C102, C103, c0100 | Weighted average of the CCF |

| 2020_5339 | Annex IV, Template C103, c0260-c0280 | PD-/PD+ for RWA-/RWA+ |

| 2017_3222 | Annex IV, Template C103 | Supervisory Benchmarking - Alternative risk weight |

| 2017_3197 | Annex I, Template C101 | Annex I Template C101.00 - Sovereigns |

| 2017_3191 | Annex II, Template C102, c0070+c0080 | Supervisory Benchmarking Exercise, Annex II, C 102, columns 070 and 080 Counterparty types |

| 2018_4093 | Annex I, C102+C103 | Category on which the covered part of exposures should be reported. |

| 2018_4091 | Annex III + Annex IV, Template C102, c0080 | Reporting of exposures whose collateral type is (g) credit derivatives, (h) guarantees or (i) unfunded credit protection |

| 2018_3934 | Validation Rules | Meaning of current year in validation rule v6167_m |

| 2015_2377 | Annex III + Annex IV | Interaction between benchmarking and additional capital requirements under Article 458 of CRR |

| 2016_2892 | Annex I, Template C101, c0050+ c0060 | Clarification of columns 050 and 060 of template C 101.00, Annex I of the Benchmarking exercise. |

| 2016_2999 | Annex III, Template C101, c0120 | Collateral value |

| 2017_3105 | Annex II, Template C102 | Clarification on Type of Facility to be used for Template C 102.00 |

| 2017_3140 | Annex I, template C101, c0020-c0080 | Use ‘AND’ or ‘OR’ rule to identify the exposure of the individual counterparties? |

| 2016_2782 | Annex III + Annex IV, Template C103, c0250-c0280 | EBA Benchmarking 2016 |

| 2015_2503 | Annex III, Template C105.01 | Template 105.01 filling for LDPs |

| 2016_2550 | Annex I, Template C103, c0030 | Clarification of the geographical scope of the benchmark portfolios |

| Question ID | Relevant Annex/Template | Subject Matter |

| 2025_0423 | (Annex 4_ITS_2025)_rep_Annex_7, Worksheet 120, C 120.02, Column 0095 | |

| 2018_4428 | EBA ITS package for 2019 benchmarking exercise (Annex V, section 2, FX instruments) | |

| 2018_4252 | EBA ITS package for 2019 benchmarking exercise (Annex V, credit spread instruments) | |

| 2018_4247 | Benchmarking - Market risk - instrument specification | |

| 2018_4244 | Benchmarking - Market risk - Base currency unit | |

| 2018_4263 | For swaps should we consider that we have a collateral agreement with the counterparty? | |

| 2017_3175 | Annex VI, template C 108.00 | |

| 2017_3135 | Clarification on the exclusion of calculation of credit spread portfolio in cases where only approval for general risk of debt instruments is granted |

| Question ID | Relevant Annex/Template | Subject Matter |

| no Q&As yet for this topic |

Template C101

| Column | Heading | Description/ field value | Min | Max |

| 0010 | Counterparty Code | Textfield | ||

| 0020 | Exposure class | Textfield | ||

| 0040 | Rating | Integer | ||

| 0050 | Date of most recent rating of counterparty | Date in format dd/mm/yyyy | ||

| 0060 | PD | Decimal | 0 | 1 |

| 0070 | Default status | Textfield | ||

| 0080 | Original exposure pre conversion factors | Decimal | ||

| 0090 | Exposure after CRM substitution effects pre conversion factors | Decimal | ||

| 0100 | CCF | Decimal | 0 | 1 |

| 0110 | EAD | Decimal | ||

| 0120 | Collateral value | Decimal | ||

| 0130 | Hyp LGD senior unsecured without negative pledge | Decimal | 0 | 1 |

| 0140 | Hyp LGD senior unsecured with negative pledge | Decimal | 0 | 1 |

| 0150 | LGD | Decimal | 0 | 1 |

| 0160 | Maturity | Integer | ||

| 0170 | RWA | Decimal |

Template C102

| Column | Heading | Description/ field value | Min | Max |

| 0010 | Portfolio ID | Textfield | ||

| 0040 | Number of obligors | Integer | ||

| 0060 | PD | Decimal | 0 | 1 |

| 0061 | PD without supervisory measures | Decimal | 0 | 1 |

| 0062 | PD without MoC and supervisory measures | Decimal | 0 | 1 |

| 0080 | Original exposure pre conversion factors | Decimal | ||

| 0090 | Exposure after CRM substitution effects pre conversion factors | Decimal | ||

| 0100 | CCF | Decimal | 0 | 1 |

| 0110 | EAD | Decimal | ||

| 0120 | Collateral value | Decimal | ||

| 0130 | LGD | Decimal | 0 | 1 |

| 0131 | LGD without supervisory measures | Decimal | 0 | 1 |

| 0132 | LGD without MoC and without supervisory measures | Decimal | 0 | 1 |

| 0133 | LGD without MoC, supervisory measures and downturn component | Decimal | 0 | 1 |

| 0140 | Maturity | Integer | ||

| 0150 | Expected Loss Amount | Decimal | ||

| 0160 | Provisions defaulted exposures | Decimal | ||

| 0170 | RWA | Decimal | ||

| 0180 | RWA Standardised | Decimal |

Template C103

| Column | Heading | Description/ field value | Min | Max |

| 0010 | Portfolio ID | Textfield | ||

| 0040 | Number of obligors | Integer | ||

| 0060 | PD | Decimal | 0 | 1 |

| 0061 | PD without supervisory measures | Decimal | 0 | 1 |

| 0062 | PD without MoC and supervisory measures | Decimal | 0 | 1 |

| 0080 | Original exposure pre conversion factors | Decimal | ||

| 0090 | Exposure after CRM substitution effects pre conversion factors | Decimal | ||

| 0100 | CCF | Decimal | 0 | 1 |

| 0110 | EAD | Decimal | ||

| 0120 | Collateral value | Decimal | ||

| 0130 | LGD | Decimal | 0 | 1 |

| 0131 | LGD without supervisory measures | Decimal | 0 | 1 |

| 0132 | LGD without MoC and without supervisory measures | Decimal | 0 | 1 |

| 0133 | LGD without MoC, supervisory measures and downturn component | Decimal | 0 | 1 |

| 0140 | Maturity | Integer | ||

| 0150 | Expected Loss Amount | Decimal | ||

| 0160 | Provisions defaulted exposures | Decimal | ||

| 0170 | RWA | Decimal | ||

| 0180 | RWA Standardised | Decimal | ||

| 0190 | Default rate latest year | Decimal | 0 | 1 |

| 0200 | Default rate past 5 years | Decimal | 0 | 1 |

| 0210 | Loss rate latest year | Decimal | ||

| 0220 | Loss rate past 5 years | Decimal | ||

| 0250 | RWA- | Integer | ||

| 0260 | RWA+ | Integer | ||

| 0270 | RWA-- | Integer | ||

| 0280 | RWA++ | Integer |

Template C105.01

| Column | Heading | Description/ field value | Min | Max |

| 0010 | Internal model ID | Textfield | ||

| 0020 | Model name | Textfield | ||

| 0030 | IRBA Risk parameter | Textfield | ||

| 0040 | EAD | Integer | ||

| 0050 | EAD weighted average default rate for calibration | Decimal | 0 | 1 |

| 0060 | Case weighted average default rate for calibration | Decimal | 0 | 1 |

| 0070 | Long-run PD | Decimal | 0 | 1 |

| 0080 | Cure rate for defaulted assets | Decimal | 0 | 1 |

| 0090 | Recovery rate of the foreclosed assets for not cured defaults | Decimal | 0 | 1 |

| 0100 | Recovery period of the foreclosed assets for not cured defaults | Integer | ||

| 0110 | Joint decision | Textfield | ||

| 0120 | Consolidating supervisor | Textfield | ||

| 0130 | RWA | Integer |

Template C105.02

| Column | Heading | Description/ field value | Min | Max |

| 0010 | Portfolio ID | Textfield | ||

| 0020 | Internal Model ID | Textfield | ||

| 0030 | EAD | Integer | ||

| 0040 | RWA | Integer |

Template C150.03

| Column | Heading | Description/ field value | Min | Max |

| 0010 | Row ID | Textfield | ||

| 0020 | Internal Model ID | Textfield | ||

| 0030 | Location of Institution | Textfield |