EU-wide stress testing 2018

The European Banking Authority (EBA) published today the results of the 2018 EU-wide stress test, which involved 48 banks from 15 EU and EEA countries, covering broadly 70% of total EU banking sector assets. The adverse scenario has an impact of -395 bps on banks' CET1 fully loaded capital ratio (-410 bps on a transitional basis), leading to a 10.1% CET1 capital ratio at the end of 2020 (10.3% on a transitional basis). The objective of the exercise is to assess, in a consistent way, the resilience of banks to a common set of adverse shocks. The results are an input to the supervisory decision-making process and promote market discipline.

02/11/2018

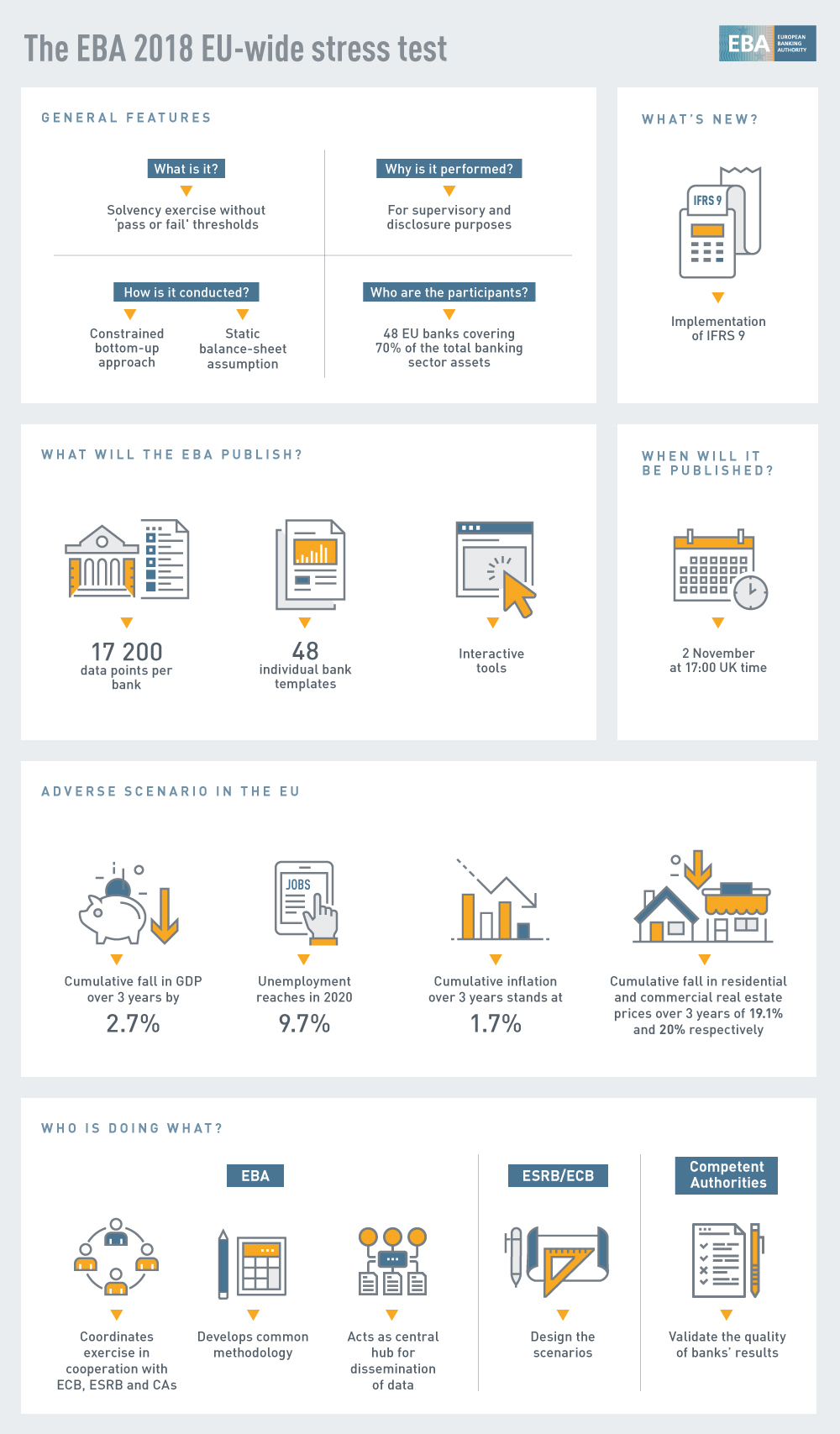

The new EBA infographics will help you find out more about the 2018 EU-wide stress test, including its key features, the key shocks of the adverse scenario, information on the underlying process and what to expect on the day of the release of the results, on 2 November.

30/10/2018

The European Banking Authority (EBA) launched today its 2018 EU-wide stress test and released the macroeconomic scenarios. The adverse scenario implies a deviation of EU GDP from its baseline level by 8.3% in 2020, resulting in the most severe scenario to date. The EBA expects to publish the results of the exercise by 2 November 2018.

31/01/2018

The European Banking Authority (EBA) will formally launch the 2018 EU-wide stress test on 31 January 2018 at 5pm UK time. Along with the announcement, the EBA will publish the common macroeconomic scenarios for this exercise.

24/01/2018

The European Banking Authority (EBA) publishes today its final methodology for the 2018 EU-wide stress test, following a discussion with industry in summer 2017. The methodology covers all relevant risk areas and, for the first time, incorporates IFRS 9 accounting standards. The stress test exercise will be formally launched in January 2018 and the results to be published by 2 November 2018.

17/11/2017

The Board of Supervisors of the European Banking Authority (EBA) agreed in its meeting held on 24-25 October 2017 on the final timeline of the 2018 EU-wide stress test. The exercise is expected to be launched at the beginning of 2018 and the results to be published by 2 November 2018. The EBA, in co-operation with Competent Authorities, is now in the process of finalising the methodology and templates with the objective of sharing them with participating banks ahead of the launch.

30/10/2017

The European Banking Authority (EBA) published today its 2018 EU-wide stress test draft methodology and templates for discussion with the industry. The exercise will cover 70% of the EU banking sector and will assess EU banks' ability to meet relevant supervisory capital ratios during an adverse economic shock. The methodology covers all relevant risk areas and, for the first time, will incorporate IFRS 9 accounting standards. The results will inform the 2018 Supervisory Review and Evaluation Process (SREP), challenging banks' capital plans and leading to relevant supervisory outcomes. The exercise will also provide enhanced transparency so that market participants can compare and assess the resilience of EU banks on a consistent basis. The list of institutions participating in the exercise is also released today.

07/06/2017

The Board of Supervisors of the European Banking Authority (EBA) agreed in its meeting held on 14 February on the tentative timeline of the 2018 EU-wide stress test. The exercise is expected to be launched at the beginning of 2018 and the results to be published in mid-year. The EBA, in co-operation with Competent Authorities, is now in the process of preparing the methodology and templates with the objective of discussing with the industry in summer 2017. The new methodology will be revised to take into account the implementation of IFRS 9 both in the starting points as well as in the projections.

27/02/2017

In its meeting on 6 December 2016, the Board of Supervisors of the European Banking Authority (EBA) decided to carry out its next EU-wide stress test in 2018, in line with its previous decision to aim for a biennial exercise. The EBA will start immediately to prepare the methodology for the 2018 stress test exercise, which will also include an assessment of the impact of IFRS 9, which will be implemented on 1 January 2018. This decision has been communicated to the European Parliament, the Council and the Commission. In 2017, the EBA will perform its regular annual transparency exercise.

21/12/2016

All you need to know about the 2018 EU-wide stress test

In this section you will find an infographic that will help you understand the 2018 EU-wide stress test

2018 EU-wide stress test results

The European Banking Authority (EBA) published the results of the 2018 EU-wide stress test of 48 banks.

The aim of the EU-wide stress test is to assess the resilience of EU banks to a common set of adverse economic developments in order to identify potential risks, inform supervisory decisions and increase market discipline.

The EU-wide stress test is coordinated by the EBA and carried out in cooperation with the European Central Bank (ECB), the European Systemic Risk Board (ESRB), the European Commission (EC) and the Competent Authorities (CAs) from all relevant national jurisdictions.

- Credit risk.csv

- Other templates.csv

- Data dictionary.xlsx

- Metadata.xlsx

- Manual for using and managing data.pdf

Summary results

Interactive tool: Interactive dashboard with main indicators and Stress test results by country and by bank

Excel tools (Excel 2010 with language settings in English (UK) for both User's System and MS Excel required)

| Description | What you can get |

|---|---|

| Summary charts | This file provides summary figures showing the impact of the stress test on capital ratios, as well as the main drivers of the impact. You can use it to compare, for example, the impact of the adverse scenario on Common Equity Tier 1 (CET1) ratio for different countries and banks by year. |

| Waterfall | This Excel file allows to visualise the contribution of main drivers to the change in CET1 capital ratio from 2017 to 2020. |

Asset quality

Excel tools (Excel 2010 with language settings in English (UK) for both User's System and MS Excel required)

| Description | What you can get |

|---|---|

Data aggregated by countries of banks | This Excel file allows to visualise data reported in the templates: non-performing exposures, forborne exposures and collateralised loans. Figures are aggregated by country of the banks. |

Individual banks' data | This Excel file allows to visualise individual banks data reported in the templates: non-performing exposures, forborne exposures and collateralised loans. |

Data aggregated by countries of banks | This Excel file provides country aggregated credit risk exposures for a specific country (AT, DE, ...) broken down by regulatory portfolio (IRB/SA) and exposure class (corporates, retail, ...), towards all the countries of the counterparty . |

Data aggregated by countries of counterparties | This Excel file provides country aggregated credit risk exposures for a specific country of counterparty (US, DE, ...) broken down by the country of the banks exposed to it (AT, DE,..) for all regulatory portfolios (IRB/SA) and exposure classes (corporates, retail, ...). |

Individual banks' data | This Excel file provides bank-by-bank credit risk exposures, broken down by regulatory portfolio (IRB/SA), exposure class (corporates, retail, ...) and all the countries of the counterparty. |

Other templates (Capital, P&L and other information)

Excel tools (Excel 2010 with language settings in English (UK) for both User's System and MS Excel required)

| Description | What you can get |

|---|---|

Data aggregated by countries of banks | This Excel file allows to visualise data reported in the templates: capital, P&L, ... Figures are aggregated by country of the banks. |

Individual banks' data | This Excel file allows to visualise individual banks' data reported in the templates: capital, P&L, ... |