How the EBA and ESM cooperate to strengthen crisis prevention and navigate an incomplete banking union

- Other

- -

How the EBA and ESM cooperate to strengthen crisis prevention and navigate an incomplete banking union

Joint article by Jose Manuel Campa, Chairperson of the European Banking Authority (EBA) and Pierre Gramegna, Managing Director of the European Stability Mechanism (ESM).

Summary

European responses to the global financial crisis and the sovereign debt crisis provided the basis for a resilient financial system. A solid institutional framework was set up, with the European Banking Authority (EBA) and the European Stability Mechanism (ESM) playing key roles in safeguarding financial stability.

Recent severe economic shocks and geopolitical turmoil have tested the robustness of the European banking sector. The banking union, a cornerstone of the new European financial architecture, has withstood the turbulence but remains incomplete, and urgency for its completion is faltering. An incomplete banking union means citizens, corporates, and banks cannot reap all the benefits of a large and integrated market for financial services.

The EBA and ESM have come together to discuss how to harness their capabilities and reinforce their functions to ensure crisis prevention and preparedness. Strengthening cooperation between the EBA and ESM will fortify the European safety net, and ultimately help cement trust and accelerate progress towards a fully-fledged banking union.

Preserving a safe financial system while unlocking its full potential

The European System of Financial Supervision, of which the EBA is an integral part, started operating on 1 January 2011. The following year saw the inception of the permanent crisis management mechanism, the ESM. About two years later, the Single Supervisory and Single Resolution Mechanisms were established within the banking union project.

Such policy actions and tools have been highly effective in avoiding further deep and prolonged crises. These sound foundations have proven resilient in the face of significant market turmoil stemming from the bankruptcy of three banks in the United States and the collapse of a major bank in Switzerland in March 2023.

Financial safety was the overarching objective of policy responses to the sovereign debt crisis.[1] To preserve it in the longer term, the banking union must still deliver on integration, efficiency, and competitiveness. To achieve this, we need more convergence across various stakeholders on the different building blocks of the banking union. While acknowledging the complexity and dependencies in this endeavour, tightening the safety net and ensuring equal protection for all depositors across the banking union remains an indispensable goal.

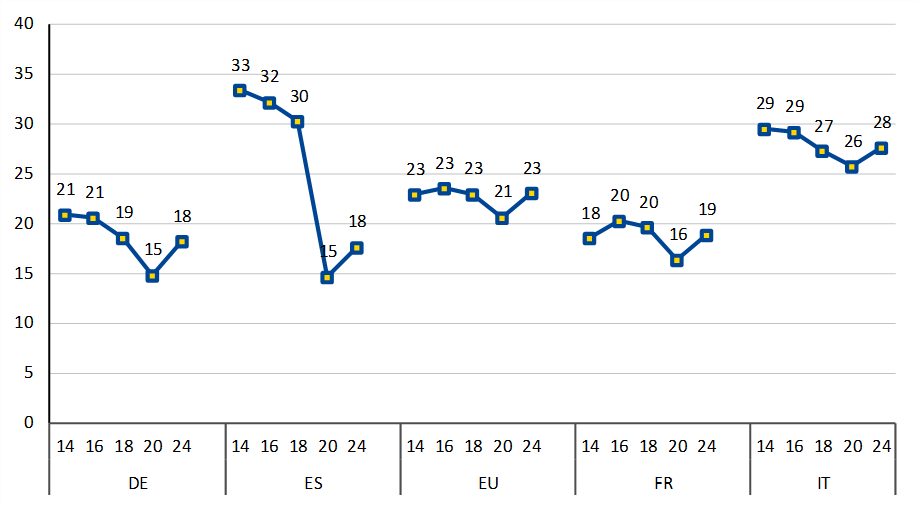

An incomplete banking union perpetrates fragmentation, resulting in inefficiencies in the allocation of resources. Because they operate in a market that is not fully integrated, European banks do most of their operations with domestic counterparts (Figure. 1), and thus miss opportunities to expand their business across borders.

Banks face constraints on the use of their capital, at times unable to allocate it to areas that could generate growth. In addition, consumers and businesses cannot access a broader range of financial services that could come from non-domestic banks. Consequently, the cost of these services remains uneven and higher than it could be in a larger and more competitive market. In such a fragmented system, European banks suffer from limited growth capacity and continue to struggle in the global competition with their peers established in other jurisdictions. Banks must tap into the benefits of the single market to become more profitable and better serve the economy and its citizens.

No integration after a decade in the banking union

| Figure 1. Exposures to other European Union (EU) countries as % of total loans and advances |

|

Note: Excluding United Kingdom figures as of December 2020.

Source: European Banking Authority

The current architecture, although incomplete, does offer some ways to minimise the inefficiencies and risks stemming from an incomplete banking union. However, the toolkit could be further expanded. To maximise the effectiveness of the banking union and pave the way for its next step, the EBA and ESM are well positioned to further reinforce crisis prevention and preparedness. This is key to boosting trust, thereby reducing uncertainty and costs.

The EBA as regulator and transparency data hub

As we approach the conclusion of a regulatory cycle, EU banks find themselves on more stable ground, benefitting from reduced uncertainty and more unified rules. However, essential pieces that are underpinning the banking union are missing: completion of the crisis management and deposit insurance framework.

In the absence of these components, alternative ways exist to foster cross-border banking. For instance, the regulatory framework already allows for more optimal levels of free flow of capital and liquidity, but these remain subject to conditions and have not widely unfolded. Meanwhile, the EBA will continue to fine-tune the Single Rulebook with more than 140 additional mandates planned for a full, timely, and faithful implementation of the Basel III framework[2] in the EU.

Regulation of the banking sector serves the critical purpose of minimising the impact of bank failures, especially during systemic crises. Since achieving a zero-failure system is elusive, the focus remains on minimising stress and ensuring resilience. Therefore, it is important to uphold and strengthen the EBA’s preventive role. Through regular ad hoc risk assessments, transparency exercises, and EU-wide stress tests, the EBA enhances market discipline and contributes to crisis prevention.

The EBA’s sixth EU-wide stress test, done in 2023, resulted in broadening the risk coverage to include evolving risks to the EU banking system. Such risks, like climate-related ones, might pose additional threats to the financial stability of the banking sector.

Looking ahead, the EBA is carrying out a one-off system-wide climate risk stress test and preparing for more regular climate stress testing to assess the impact of environment, social, and governance risks under adverse conditions.

The launch of the EBA’s Pillar 3 Data Hub platform will allow centralised access to prudential disclosures from EU institutions, a significant milestone to come in 2025. Such readily available information through a single access point on the EBA website will facilitate usability and comparability, thereby strengthening the EBA’s role in promoting market discipline.

The ESM as insurance, and fire-fighter

In an ever-changing landscape, crises of various nature can strike unexpectedly. Despite the robustness of the euro area banking system, new crises will continue to emerge and threaten financial stability. The ESM has learned valuable lessons from past crises: the better understanding and early detection of vulnerabilities helps prevent crises and reduce their impact.

As a permanent crisis resolution mechanism for the euro area, the ESM closely monitors economic and financial conditions across its member states. By identifying tail risks and vulnerabilities, it remains ready to intervene when needed. Anticipating policy responses helps soften the impact and minimise the costs associated with crisis management.

As discussed in a previous blogpost, the ESM looks at precautionary instruments as flexible tools that can be adapted to address various types of future shocks.[3] These instruments are intended to prevent potential small crises from escalating. Available to all euro area countries with sound economic fundamentals, they act as a buffer against adverse shocks that are beyond their control.

By helping counter fragmentation, these precautionary instruments reduce market uncertainty and volatility that affect member states differently. As demonstrated during the pandemic, these instruments – whether within the existing or revised ESM Treaty – can provide essential support when new external shocks occur or should national safety nets prove insufficient.

Similarly, the ESM’s indirect bank recapitalisation instrument, used to counter a systemic banking crisis in Spain, remains relevant. It can be helpful to address stressed conditions in the financial sector, under various circumstances. This could be the case when the impact of climate change, including environmental disasters, or severe market turmoil ensuing from liquidity strains hit banks. The possible use of this instrument in case of financial stability risks in non-bank financial institutions could also be considered. The ESM has published a toolkit review which explores such use-cases of existing instruments[4].

The reformed ESM Treaty, which is pending full ratification,[5] provides a legal basis for a set of new tasks and a new instrument, the backstop for the Single Resolution Fund. This instrument would support the orderly resolution of large banks, should the Single Resolution Fund be depleted. Such a second line of defence greatly reduces uncertainty on the outcome of the resolution of failing banks and minimises further the impact of such failures on financial stability and fiscal discipline. Moreover, it reinforces international investors’ trust in our banking system.

Joining forces to become even more effective

Strong collaboration between European institutions with a shared mission of ensuring financial stability is paramount. By sharpening our ability to detect risks, responding promptly to crises, and helping prevent crises from unfolding, we minimise the costs of an incomplete banking union. Thus, collaboration bridges the gap until we reach full implementation of the banking union.

Cooperation can take different forms: we aim to progress from regular information exchanges to deeper dialogues on emerging trends and vulnerabilities, crisis simulation exercises, other joint projects, and staff exchanges.

The EBA and the ESM are committed to deepening their effective collaboration, strengthening their analytical capabilities, maximising the effectiveness of their tools, and investing in human capital. This is vital to contribute to prosperity in Europe and to fulfil their institutional objectives.

Consolidate trust to foster the completion of the banking union architecture

While stronger policy action on prevention and preparedness is crucial, it falls short of a fully integrated banking union and a unified safety net. Without it, there is a risk that corrective measures might be delayed due to concerns about negative market reactions and uncontrollable spillovers. The confidence instilled by a complete banking union remains unmatched.

Efforts to strengthen the resilience of banks and the credibility of the institutional framework should continue alongside effective crisis prevention. This dual approach will help build political consensus and pave the way for decisive steps toward completing the banking union architecture.

Capital market integration should also go hand in hand with the completion of the banking union, as stated by the Eurogroup on 11 March 2024.[6] The renewed policy focus on developing capital markets union is promising. Together with a robust banking union, it is instrumental in preserving and nurturing stability and resilience. It will multiply avenues to diversify risk, allocate capital, absorb shocks, and fully unleash the available resources to finance economic growth and innovation.

[1] See Completing banking union to support Economic and Monetary Union | European Stability Mechanism (europa.eu)

[2] Basel III is framework that sets the international standards of bank capital adequacy, stress testing, and liquidity requirements.

[3] N. Giammarioli, M. Sušec (2024), “Shock proofing ESM financial stability instruments”, ESM blogpost.

[4] European Stability Mechanism (2024): “Comprehensive review of the maximum lending volume, adequacy of the authorised capital stock and financial assistance instruments”, ESM staff.

[5] The reformed treaty will come into force when ratified by the parliaments of all 20 ESM Members.